Section title

DESCRIPTION

The ACTIVE BALANCED portfolio model invests in a combination of treasury bills, bonds, ETFs and stocks that are or will be in a state of upward momentum. The purpose of the investment is to generate income and capital growth. Minimum investment amount 40.000€.

Section title

PERFOMANCE

Note: The return on investment does not include the cost of investments. The capital investment is subject to changes and return of the investor's portfolio may be lower or higher than the standard portfolio.

Performance per time period.

Note: The return on investment does not include the cost of investments. The investment capital is subject to change and the return on the investor's portfolio may be lower or higher than the standard portfolio.

Since the inception of the Portfolio.

Note: The return on investment does not include the cost of investments. The investment capital is subject to change and the return on the investor's portfolio may be lower or higher than the standard portfolio.

Since the inception of the Portfolio.

Note: The return on investment does not include the cost of investments. The investment capital is subject to change and the return on the investor's portfolio may be lower or higher than the standard portfolio.

The securities that contributed the greatest return to the overall portfolio since its inception.

Note: The return on investment does not include the cost of investments. The investment capital is subject to change and the return on the investor's portfolio may be lower or higher than the standard portfolio. To find out about all the titles in the portfolio, contact us here.

The securities that contributed the lowest return to the overall portfolio since its inception.

Note: The return on investment does not include the cost of investments. The investment capital is subject to change and the return on the investor's portfolio may be lower or higher than the standard portfolio. To find out about all the titles in the portfolio, contact us here.

Fill out the form of interest and we will contact you as soon as posibble.

Section title

RISK

The value of a portfolio changes with the changes in the value of the titles in which it invests. It is important for the investor to know the level of risk, the risk factors of his portfolio and other statistics, according to past data.

Based on the volatility of the Portfolio, its level of risk is:

Financial instrument risk categories are based on the calculation of five-year volatility, where this is possible due to the adequacy of historical data. In case of insufficient 5-year historical data, we use the data from the beginning of the portfolio until the date of the last report. Find out more about how to calculate from the European Securities and Markets Authority (ESMA) here.

V.A.R: Calculates the maximum possible loss that a portfolio can suffer for a given time period and for a given confidence level.

Measurements and statistics of the portfolio are provided by the Refinitiv / Hellas Fin database.

Portfolio Volatility Statistics by Time Period.

Measurements and statistics of the portfolio are provided by the Refinitiv / Hellas Fin database.

Portfolio performance measurements in relation to its risk.

Measurements and statistics of the portfolio are provided by the Refinitiv / Hellas Fin database.

Portfolio performance measurements in relation to its Benchmark.

Measurements and statistics of the portfolio are provided by the Refinitiv / Hellas Fin database.

Fill out the form of interest and we will contact you as soon as posibble.

Section title

ANALYSIS

Fundamental analysis is a method of evaluating companies, securities, stocks, and other investments in an attempt to calculate their value, examining a number of qualitative and quantitative economic factors.

Measurements and statistics of the portfolio are provided by the Refinitiv / Hellas Fin database.

Section title

HOLDINGS

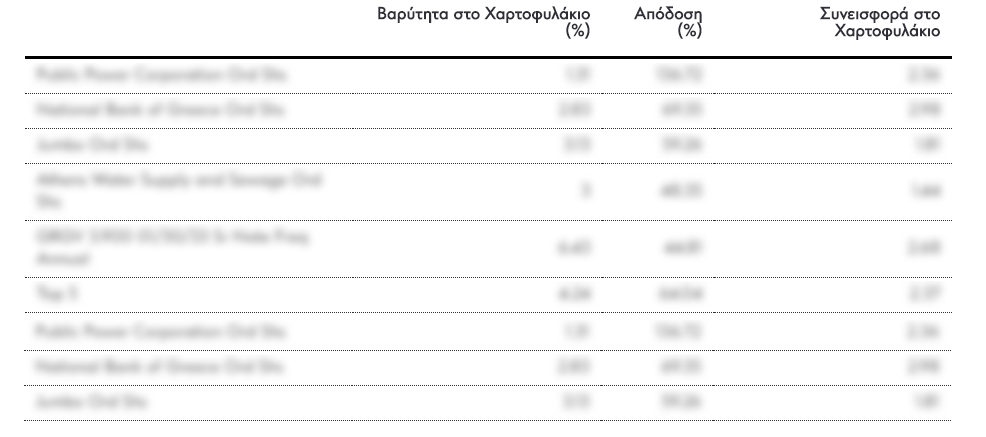

The holdings that contributed the most return to the overall portfolio since its inception.

To find out about all the titles in the portfolio, contact us here.

The holdings that have contributed the least return to the overall portfolio since its inception.

To find out about all the titles in the portfolio, contact us here.

Explore all HellasFin STANDARD INVESTMENT PORTFOLIO.

HellasFin Investment Services S.A. is an independent wealth management company providing investment advice and portfolio management, licensed by the no. 6/160 /2.6.1999 decision of the Hellenic Capital Market Commission. It is prohibited without the prior written permission of the company or its providers, whether in whole or in part, the sale, copy, modification, republishing, reproduction or otherwise exploitation of any elements of this presentation, which are subjects of intellectual property rights of the company or its providers. Investing in financial instruments entails risks that the client expressly declares that he accepts in the contractual agreement that he signs. These risks consist of, by and large, declines in the value of the investment or even loss of the invested capital.

Under certain circumstances, the client may be obligated to pay additional amounts to those originally invested, to cover eventual damages created. It is particularly needed for the customer to take the risks into account when taking investment decisions, and to avoid any investment and trade, for which it is considered by him that he has a lack of the necessary knowledge or experience. If the client does not fully understand the risks, it is recommended to communicate with his investment advisor in order to obtain the necessary information. The returns on investment in the past do not guarantee a similar or better return in the future. The value of an investment may either fall or rise and investors may not get equal or better returns on the invested amounts.